Click on a link below to go direct to each fact:

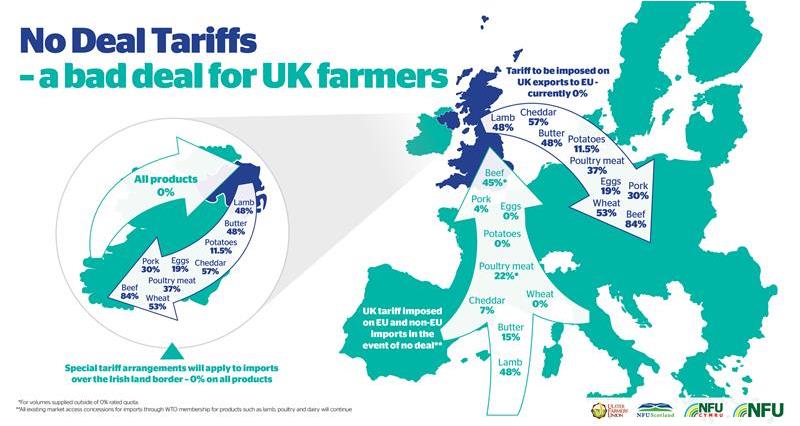

- EU tariff on UK exports: The EU has said it will tax UK products exported to its market. That amounts to a new tax equivalent to at least £1.36bn* on exports of UK beef, lamb, pork, dairy products, poultry meat, arable crops, flour, malt. (*based on value of trade in 2017). Either EU consumers will have to pay more to continue enjoying those Great British products or the new tax could ultimately come off UK farmers bottom line in order to maintain sales. In the extreme, tariffs could mean British product simply no longer being sold on the EU market as it is priced out of the market. See: NFU responds to UK tariff review on NFUonline here.

- UK tariffs on imports: The UK government has said it will not reciprocate and apply similar levels of tariffs on imports to the UK market. There will be no or very limited tariffs applied on agriculture and food products coming onto our market from the EU and around the world. Products such as cheddar, beef, pork and poultry meat will have limited protection, whilst arable crops, many other dairy products, eggs and fruit and vegetable will have no tariff protection at all – opening up our market to products that don’t meet our environmental or animal welfare standards and undermining UK farmers efforts in these areas. See: NFU responds to UK tariff review on NFUonline here and Temporary tariff regime updated on Gov.UK here.

- Honouring WTO commitments: The UK government has said that it is absolutely committed to maintaining its share of all of the trade and preferential market access concessions to our market that it has granted our international partners over the years by virtue of our WTO membership – for example this means that countries such as New Zealand will continue to benefit from duty free access to the UK market for up to 114,000 tonnes of lamb and Thailand and Brazil duty free access to our poultry market. Watch and share our video below on how a no-deal Brexit would affect British farming.

- Loss of preferential trade access: Our government has only managed to secure preferential trade terms covering less than half of the total amount of agri-food export trade we had with the rest of the world by virtue of our EU membership. Key markets like Turkey, Canada, Mexico, Japan have not been secured, threatening the viability of more than £1.5billion worth of UK agri-food export trade. See: UK trade agreements with non-EU countries in a no-deal Brexit on Gov.UK here.

- EU nationals: Hundreds of thousands of EU citizens fill a variety of highly valuable roles in the agri-food sector both on farm and elsewhere in the food production chain. Brexit uncertainty has driven years’ of labour shortages, particularly in the horticulture industry where the latest statistics show that from January to August this year nearly 2,000 vacancies went unfilled for seasonal fruit and vegetable pickers. While policy is in place to maintain EU nationals’ right to work in the UK until December 2020, there is little clarity beyond that. This is undermining UK business’ ability to recruit and invest for the medium and longer term, compounding production difficulties caused by short term staff shortages. See: Settled status EU citizens families and No deal immigration arrangements for EU citizens moving to the UK after Brexit on Gov.UK

- POAO (Products of Animal Origin) Listing: In order for exports of animals and animal products to continue if the UK leaves the EU without a deal, the European Commission will need to vote whether to list the UK as a ‘third country’. With 20 days to go, this vote still hasn’t taken place, reducing the time between the EU’s decision and the time in which exporters will need to know for sure that the EU will accept these products. See: EU listing of UK and its establishments on Gov.UK here.

- Export Health Certificates: Every consignment of “products of animal origin” destined for the EU market will require a vet to sign an Export Health Certificate, attesting to the health status of that consignment. The government has not been able to estimate how many vets will be required to cover demand, but it has been estimated that the number of certificates needed will run into many millions. The exact form of certificates and how products will be classified is also unclear. This could create particular difficulty for animal by-product exports. Failure to collect and safely process waste could lead to a backlog of waste on farm and it needing to find alternative disposal routes through incineration and landfill. See: Guidance on how to get an EU export certificate on Gov.UK here.

- Export Health Marks: UK products of animal origin destined for the EU market will not be able to use the current ‘EC’ health and identification marks to demonstrate that the product has come from an approved establishment. This means that food business operators will have to use a new identifier. The default health and identification mark will be “GB”. The revised form of the health and identifications marks will need to be used from day one onwards for certain POAO produced in the UK and placed on the UK, EU and non- EU country markets. The change will create confusion and the potential for mis-marked product to be rejected by importing inspectors in the EU. See: Health and identification marks on Gov.UK here.

- Northern Irish milk: The UK dairy industry produces 14.75bn litres of milk per year. We export the equivalent of 3.25bn litres of milk in the form of liquid and processed product to the EU each year - including around 800 million litres of raw milk exported to the Republic of Ireland from Northern Ireland. A new tariff ranging between 37-63% (depending on fat content) would apply to exports of milk from NI to ROI. The total additional tariff burden on UK exporters of dairy product would be £486million – crippling in a highly competitive global market- resulting in oversupply of milk in the UK market. The logical outcome will be a severe collapse in UK milk prices. Every 1ppl drop in average UK dairy farm gate prices equates to £140m loss to the industry. See: Dairy no-deal Brexit analysis on NFUonline here.

- Currency fluctuations: UK farm incomes will face significant challenges from currency depreciation. There is an argument that weakening sterling might - when the market is in equilibrium - underpin higher commodity prices. But farm margins are already being squeezed by the fall in the value of sterling since the referendum; fertilizer costs have increased by 34%, energy and lubricants by 28%, crop protection products by 20% and animal feed costs have increased by 19% - much of this attributed to the fall in the value of the £ against the € and the $. See: Latest agricultural prince indices on Gov.UK here.

- Border Inspection Posts: Every consignment of animals and products of animal origin will have to enter the EU through a Border Inspection Post (BIP). It is unclear which EU BIPs will accept which live animals and it is currently understood that some, such as Calais, will accept none other than horses. This will create significant disruption to the export of high value live animals for breeding purposes for example. See: Further information on BIP on Europa here.

- Organic certification: UK organic farmers will not be able to market their product as organic on the EU market in no-deal Brexit. This is because the EU will require UK organic certification bodies to be recognised as having the same organic production standards as those in the EU – a process that government has estimated will take up to 9 months. Although the Government hopes this will take less time, UK organic farmers will be locked out of exporting to the EU organic market during that time. See: Exporting organic food to the EU on Gov.UK here.

- Egg and poultry meat marketing rules: UK egg producers will not be able to export any eggs or egg products to the EU at all until the EU evaluates UK regulations and concludes they are equivalent. The same is true for producers of free range poultry meat, whereby until the EU recognises the UK’s regulations, UK poultry meat will not be able to be sold as free range on the EU market. Neither process will be completed in time for 31 October, shutting UK producers out of the EU market until approval is given. See: Egg marketing standards if there’s a no-deal Brexit and Exporting poultry meat from the UK to the EU on Gov.UK.

- Hops certification: UK Hop farmers will not be able to export hops to the EU until the EU certifies UK production. It is unclear how long this process will take and the timing of Brexit (31 October) means that it would affect the main time of year when Hops is traded with the EU. See: Exporting hops to the EU after Brexit on Gov.UK here.

- Seed and ware potato ban: UK seed and ware potato farmers will not be able to export their product to the EU, despite having some of the highest health status for these products in the world. The EU rules require the UK to be listed as an authorised third country and it is unknown how long this process will take. In the meantime, potatoes from the EU and elsewhere will still be authorised to enter the UK market. See: If third-country equivalence is not granted by the EU on Gov.UK here.

- Labelling rules: The EU and other non-EU countries will require product to be accurately labelled for access to their markets. Product labelled prior to 31 October and sold after that date on those markets may not be compliant. In these instances, the UK government can only recommend that labels are replaced or over-stickered as required to ensure they are fully accurate. This would include ensuring country of origin labelling, health marks and responsible business addresses were correct. This will create extra work and costs for businesses at very short notice. See: Food and drink labelling changes if there's a no-deal Brexit on Gov.UK here.

- EU plant health rules: The EU has stated its intention to apply third country controls on imports of plants and plant material from the UK, including for example leeks, shallots, tomatoes and raspberries. This means there would be increased requirements on UK plant health inspectors to issue phytosanitary certificates for exports of regulated commodities to the EU. See: Exporting plants and plant products to the EU on Gov.UK here.

- Delays at the border: The government has said that delays will occur where significant numbers of HGVs try to cross into the EU via the channel/short straits without the correct documentation. Their latest publicly available reasonable worst case planning assumption is that such HGVs could face maximum delays of 1.5 to 2.5 days. Such delays would render trade in perishable goods such as fresh produce unviable. See: The Operation Yellowhammer government plans here.

- Seeds and plant propagating material: To continue marketing seeds and other plant propagating material in the EU after Brexit the UK needs to gain third country equivalence with the EU. The UK Government has said that it knows from other third country applications that this approval process could take up to 2 years - locking UK seed and propagating material out of the EU market whilst this process is completed. See: Plant variety rights and marketing plant reproductive material if there’s a no deal Brexit on Gov.UK here.

- Phase out of BPS: Despite the chaos of a no-deal exit, the government has refused to accept the need to delay the start of the planned phase out of the BPS farm support payments in England from 2021. See: NFU calls for delay to farm support changes after Agriculture Bill falls on NFUonline here.

More from NFUonline: