Not only will the government’s approach put significant additional financial pressure on farmers at precisely the time they will be facing enormous challenges from a no-deal Brexit, but it also risks the UK being flooded with imports produced to lower standards that would be illegal for UK farmers.

Mrs Batters said: “I wrote to the Prime Minister only a few weeks ago to express our concerns with the approach the government took back in March to import tariffs in a no deal scenario. But with the chances of us leaving in less than four weeks without a deal increasing by the day, the Prime Minister has missed a real opportunity to back British farmers.

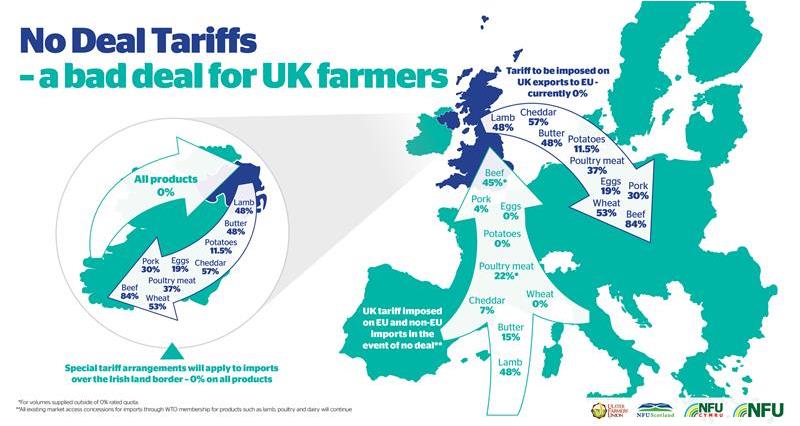

“Farmers and growers are understandably anxious to know that the government will take all steps necessary to help the sector avoid the worst impacts of leaving the EU without a deal. Instead we will see – from day one – farm businesses facing new, high tariffs on much of the 60% of our exports that go into the EU, while tariffs on goods coming into the UK will be set far, far lower and in many cases won’t be applied at all. In particular, British egg farmers, British cereal farmers, our horticultural growers and many of our dairy farmers will have zero protection against cheap imports coming in from around the world.

“Without the maintenance of tariff protections, we are in danger of opening up the UK to imported food which would be illegal to be produced here, produced at a lower cost because it may fail to meet the environmental and animal welfare standards which are legally required of our own farmers - flooding our market and resulting in unsustainable price falls. Not only could this be terrible news for farmers, whose very businesses will be under threat, but also for consumers who enjoy the high-quality and affordable British food they produce."

“While it is clearly important that the government manages prices for consumers in a no-deal scenario, border tariffs have very little impact on retail food prices. They can, however, have a massive impact on the viability of farm businesses and our ability to produce high quality, great British food. I believe that offering some limited tariff protection and managing volumes through a system of import quotas would have struck the right balance between protecting the interests of domestic producers and keeping retail food prices under control.

“Farmers are going to feel betrayed by this government’s failure to act now in making sure that all that can be done is being done to help mitigate the damaging effects of a no-deal Brexit. I don’t recall anyone selling a vision of post-Brexit Britain as one involving lower standard food filling shop shelves while British farmers, the guardians of our cherished countryside, go out of business.”

Watch: How a no-deal Brexit would affect British farming

What do the tariffs mean for your farming sector?

Key elements of the government’s policy:

There will be full tariff protection for the sheep meat sector. This means no additional market access and no reduction in the full external tariff (12.8% + €171.3/100kg). Existing market access concessions for countries such as New Zealand lamb will continue (the existing New Zealand quote equates to 114,000t). New Zealand lamb imports account for 74% of our imports. That lamb will continue to enter the UK duty free.

The government has announced the creation of new autonomous Tariff Rate Quotas (TRQs) to manage import volumes of beef. A TRQ comprises two parts :

- a Tariff Rate and;

- a Quota (volume).

The “in quota” Tariff Rate for beef will be zero and the volumes granted access (quota) to this zero duty rate is slightly lower than that which we currently see coming in duty free from the EU. The quota for “Fresh/ Chilled Beef” (0201 codes) will be 124,401t. The quota for “Frozen beef” (0202 codes) will be 56,217t and for processed beef (0210 + 1602 codes) the quota will be 50,042t. All together this would see duty free market access for around 230,000t, which leaves approximately 95,000 tonnes of beef imports currently entering the UK market duty free from the EU, potentially subject to the new UK tariffs (depending on whether the trade is direct from ROI to NI).

The quotas will be managed quarterly (spread in differing proportions across the year) and on a first come first served basis. The quotas open 1 November 2019. Unfortunately, the quotas will be managed at the 4 digit code level. This means that fresh/ chilled carcase will be treated the same as fresh/chilled boneless cuts, potentially skewing the market resulting in a surge in boneless cuts entering our market.

The out of quota duty for beef is significantly lower than that which the EU currently applies to 3rd county imports. For example the UK tariff for out of quota imports of fresh beef would be 6.8%+€93.3/100kg. This is compared to 12.8% + €176.8/100kg currently applied by virtue of EU membership.

The government has announced the creation of new autonomous Tariff Rate Quotas

(TRQs) to manage import volumes of poultry meat. The “in quota” Tariff Rate for poultry meat will bezero and the quota volume for fresh and chilled poultry meat benefiting from that zero duty is 166,196t and for frozen it is 79,510t. The quotas are managed quarterly and the volumes spread across the year in differing proportions.

The out of quota tariff lines (there are multiple depending on the product line) is significantly lower than the level of tariff the EU currently applies to 3rd country imports. For example, the UK tariff on boneless cuts of fresh poultry meat would be €61.8/100kg, as opposed to the EU tariff currently applied to 3rd country imports of €102.4/100kg.

Import volumes will not be managed through the use of any concessionary TRQs. However for some cheeses and for butter UK tariffs will apply. For example the UK will apply €60.5/100kg for butter and a duty of €22.1 /100kg for cheddar. This means that tariffs will apply on EU butter and cheese coming into the UK market (with the exception of trade direct from ROI to NI). However it is important to note that the UK tariff is significantly lower than the tariff the EU currently applies (for example the EU tariff on Butter is €189.6/100kg and cheddar is €167.1kg/100kg).

Import volumes will not be managed through the use of any concessionary TRQs. However

UK tariffs will be applied, including to imports from the EU (with the exception of trade direct from ROI to NI). The rate of duty varies depending on the category of pork. The UK tariff is significantly lower than the level the EU currently applies to 3rd country imports. For example the UK tariff for fresh boneless pork would be €11.4/100kg, as opposed to EU tariff €86.9/100kg.

There is no tariff protection afforded these products. In other words there is full trade liberalisation. This is deeply concerning given the fact that UK exporters will face tariffs if they send product to the EU.

There is a TRQ for raw cane sugar for refining equating to 260,000t. The in quota duty is

zero and the out of quota duty remains at €33.9/100kg.

There will be a UK tariff applied to imports of fertiliser of 6.5%.

More from NFUonline: