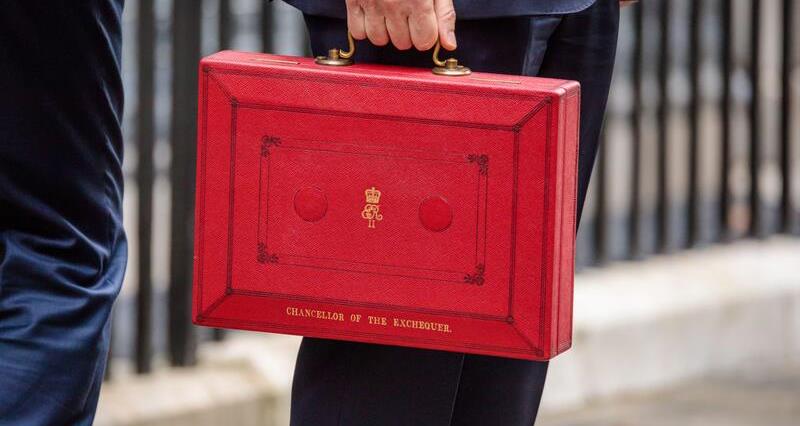

Monday saw a general debate on rural affairs take place where announcements made in the Autumn Budget on changes to Inheritance Tax were a central feature.

The NFU briefed MPs ahead of the debate, where we made clear that the changes announced in the budget could increase food costs to consumers adding pressure to many still experiencing the cost-of-living crisis.

What did MPs say?

Newly appointed Shadow Defra Secretary Victoria Atkins said that APR is not a loophole for farmers but is a policy designed to “prevent family farms from being split up and sold off”.

Liberal Democrat spokesperson Tim Farron noted that a large number of farmers live on significantly less than the minimum wage and tenant farmers will be indirectly affected by these changes as landowners repurpose land to pay tax bills.

Chair of the Efra Committee Alistair Carmichael said that the Treasury’s figures which were used as the basis for changing APR need much more robust scrutiny.

The Treasury has said 73% of APR claims are below £1 million and so would be unaffected by this policy. However, Defra’s figures show that only 34% of farms are under £1 million net worth.

Last night in the House of Commons, MPs from across the House continued to raise concerns about the #FamilyFarmTax

— NFU Political (@NFUPolitical) November 12, 2024

The Treasury’s figures are based on past APR claims and do not consider farms that have also claimed BPR for diversified aspects of their businesses.

Mr Carmichael added that closing a loophole at the expense of family farms is “unjustifiable”.

Labour MP for Whitehaven and Workington Josh MacAlister called on the government to consider transitional support for those passing down their farms “who may now be caught out by changes announced in the Budget”.

The Conservative MP for Chester South and Eddisbury Aphra Brandreth later tabled an Adjournment Debate on mental health in farming and agricultural communities. She said that “the decision on APR has once again brought rural mental health to the forefront”.

‘The feelings of anger, betrayal and despair are palpable’

NFU President Tom Bradshaw said: “Since the Budget, I’ve heard about distressed elderly parents who are having to apologise to their children in tears for something that isn’t their fault, telling them they’re sorry because they feel they’re now a burden on the family.

“I’ve heard from families who can’t see any way they can plan for a future which doesn’t result in losing their business. Men and women who’ve spent years building up farm businesses now wondering what’s the point in carrying on when it’s going to be ripped apart.

“The feelings of anger, betrayal and despair are palpable. There is already a mental health crisis in the farming community. In 2021, a survey by farming charity RABI showed that over a third of the farming community had experienced depression and around half had experienced anxiety. And now this family farm tax is exacerbating this crisis.

“We have been speaking to MPs ahead of the debates in Parliament to ensure the impact on family farms is front and centre of discussions.”

NFU President Tom Bradshaw

“The vast majority of the people who’ll bear the brunt of this family farm tax aren’t wealthy people with huge cash reserves hidden away. They are families that have often spent generations building up their farm businesses to provide food for the nation, often on very tight profit margins.

“Their businesses have struggled through all the changes caused by Brexit, they’ve suffered years of being squeezed to the lowest margins imaginable with costs of production skyrocketing, and they’ve been battered by increasingly extreme weather conditions.

“They have nothing left to give.”

Show your support

Tom added: “We have been speaking to MPs ahead of the debates in Parliament to ensure the impact on family farms is front and centre of discussions. With our mass lobby of MPs only a week away, we will be continuing these conversations to ensure the pressure to reverse the family farm tax is not only coming from farmers, the public and the media, but backbenchers and Ministers too.”

On 19 November, farmer and grower members of the NFU will meet with their MPs in Parliament, urging them to ask the Chancellor to reconsider changes to Inheritance Tax. Find out more about the mass lobby.

You can show your support and join our call for the government to overturn the family farm tax by adding your name to our online campaign.