“Now is the time to make our voices heard” – that was the message from NFU President Tom Bradshaw as he called on the government to deliver an increased agriculture budget on 30 October.

The NFU is calling for a renewed and enhanced multi-annual agriculture budget of £5.6 billion the majority of which is needed to deliver the government’s environmental goals, with the remainder looking to drive productivity and support the economic stability of farm businesses, all supporting the health and wellbeing of our nation.

Challenges, such as climate change, and statutory commitments, such as the Environmental Improvement Plan, need to be matched by a renewed commitment to ensure the nation’s food security and help farming boost domestic production, as set out in the National Food Strategy.

“I urge all members to use our campaigning letter template to write to their MP to tell them why the agriculture budget is so important to their businesses,” the NFU President added.

“It’s vital we show that this is an issue that affects farmers across the whole of the country.”

The NFU has written a letter to Prime Minister Sir Keir Starmer calling on him to stand by his commitments to British farmers and growers. We have also written to the Chancellor, outlining our 7 key asks for farming ahead of the Autumn Budget.

What has the PM promised?

During the NFU’s Conference in 2023, Prime Minister Sir Keir Starmer, then Leader of the Opposition, delivered a keynote speech where he pledged Labour’s aspirations to “govern every corner of our country and will seek a new relationship with the countryside and farming communities on this basis, a relationship based on respect and on genuine partnership”.

Hold the government to account on this promise and use our tool to write to your MP today.

£5.6bn budget needed

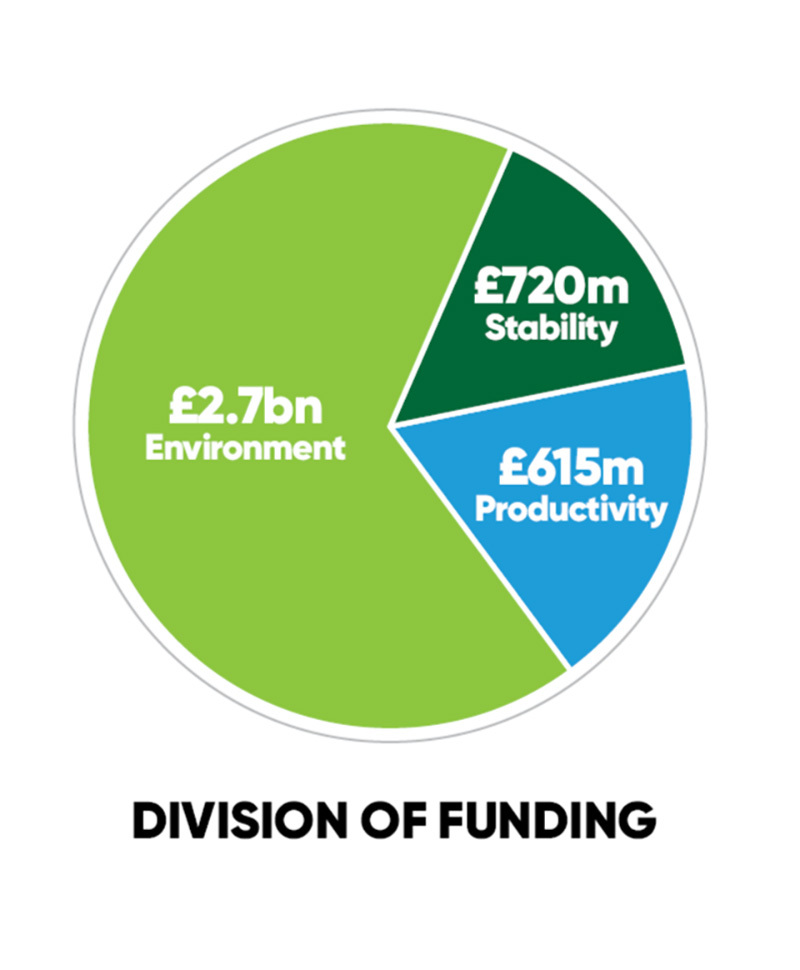

The NFU commissioned The Andersons Centre* to model the public funding required to deliver the government’s ambitions for agriculture in England over the 2025 to 2030 period, structured around our three agricultural policy cornerstones.

The research indicates that an annual agricultural budget for England of around £4 billion would support the delivery of a balanced agricultural policy which underpins global competitiveness:

- around £2.7 billion to meet the government’s environmental goals

- £615 million for driving productivity

- £720 million to support the economic stability of agricultural businesses

Respecting the nature of devolved government, we estimate this would translate to a UK-wide budget of around £5.6 billion.

The modelled budget does not capture every spending requirement, due to the interactions of funding need with policy design which are difficult to fully account for.

However, it does provide a strong indication of the level of budget required to deliver a globally competitive, productive, resilient, innovative and sustainable agricultural sector that would drive significant environmental improvements at unprecedented scale.

Division of funding

A balanced agricultural budget for the next parliament should be structured around the NFU’s three longstanding agricultural policy cornerstones:

- environment

- productivity

- stability

Investment in productivity and stability will ensure a competitive and resilient agricultural sector, while investment in environmental delivery also contributes to the resilience of our food systems, our environmental ambitions and a more sustainable economy.

British farming contributing to the economy

|

The agri-food sector's contribution to the UK economy (GVA) in 2021 was £127 billion. |

|

The number of people working on UK agricultural holdings in 2022 was 471,000. |

|

69% of the UK's land area is farmed. |

|

Agri-food sector jobs in 2022 were just under 4.2 million. |

|

The number of businesses in the UK registered as farm businesses in 2022 was 142,500. |

|

UK food and drink exports in 2022 were £24.8 billion. |

|

UK food self sufficiency is currently (2022) at 60%. |

|

The amount UK shoppers spent on food and drink products in 2022 was £281 billion. |

|

The percentage of farm businesses that had some form of diversification in 2021/22 was 68%. |

|

Farmers produce renewable energy that helps to power an average of 10 million UK homes. |

*The Andersons Centre provides industry-leading business advice, research and analysis to the agricultural, rural and food sectors across the UK

See our progress on the fight for the farming budget

Cherished toys delivered to Treasury as symbol of futures lost to family farm tax

A basket of pre-loved farm toys, representing a farm and a future generation that could be lost, was handed over to the Treasury by three generations of a farming family with a heartfelt message to the Chancellor – that the unjust family farm tax will deny the children of Britain’s farming families a future in the industry.

APR and BPR reform alternative published

The NFU proposes an alternative approach to the government’s planned reforms to APR and BPR, known as a ‘clawback’ mechanism.

NFU meets with Treasury Minister

The devastating impact on farming families and the nation’s food security from the family farm tax sits squarely on the government’s shoulders, the NFU says, after ministers bluntly refused any suggestion of a compromise offered by farming unions and organisations.

The stark warning comes after Exchequer Secretary James Murray and Food Security Minister Daniel Zeichner called in representatives from across the farming sector, and the wider UK farming unions, only to tell them the government had no interest in compromise. This is despite the NFU utilising the meeting to put forward a potential 'claw back' solution which multiple tax experts have also proposed.

Following the meeting, NFU President Tom Bradshaw said: “This morally bankrupt position sits with this government” and warned that, “without change, ministers will reap the consequences”.

Photograph: George Dunn, Tenant Farmers Association, Victoria Vyvyan, Country Land and Business Association, NFU President Tom Bradshaw, Jeremy Moody, The Central Association for Agricultural Valuers. Credit: Lloyd Sturdy

Young farmers warn their future is at risk if family farm tax isn't overturned

A number of young farmers and growers voice their concerns to MPs at a drop-in event ahead of a Westminster Hall debate on the family farm tax petition.

The event was an opportunity for MPs to hear from 14 young farmers and growers about how the family farm tax will impact them. Representatives from the south, north, midlands, east and Wales attended.

NFU President Tom Bradshaw said it is clear from hearing these stories that the impact of the tax hike will be felt “not just today but for generations to come”.

Photograph: Young farmers meet with Rt Hon James Cleverly MP

Farming families to send pre-loved toys to Chancellor in symbolic gesture

The NFU announces plans to bring to life the effect of the government’s proposed inheritance tax changes on all farming generations with a display of tractors and pre-loved farm toys outside its annual conference in London on 25 February.

A multi-generational farming family will also hand over a selection of pre-loved farming toys to the Treasury with a message to the Chancellor.

Find out how you can donate a toy.

Photograph: Alamy /Jeff Gilbert

Dairy sector unites against family farm tax at Dairy-Tech

The dairy sector shows its support for the NFU's Stop the Family Farm Tax campaign, with businesses adding signatures to our campaign pledge board at Dairy-Tech, and processors, with a turnover of more than £7 billion, signing a joint letter to the Treasury to warn against changes to IHT.

Speaking at Dairy-Tech, NFU President Tom Bradshaw said: “It’s fantastic to see the dairy sector coming together and supporting our Stop the Family Farm Tax campaign.”

Food industry coalition issues warning to the Treasury over IHT changes

More than 50 signatories representing the food manufacturing industry have joined forces as never seen before to urge the Treasury to rethink its proposed changes to inheritance tax announced as part of the Autumn Budget.

Find out more about the letter and who has signed.

The news follows another letter sent to the Chancellor the week before from NFU President Tom Bradshaw, NFU Cymru President Aled Jones and NFU Scotland President Martin Kennedy, requesting a meeting ahead of the Spring Statement.

AHDB findings reinforce results of NFU impact analysis

New AHDB analysis has found that the government’s proposed changes to inheritance tax will affect more than 75% of English and Scottish farms – reinforcing findings in the NFU’s own impact analysis.

Photograph: INSADCO GmbH / Alamy

Farming Day of Unity

The Farming Day of Unity sees farmers, supportive industries, and the public come together in a demonstration against the family farm tax as pressure continues to mount against the government’s plans.

NFU President Tom Bradshaw describes the Day of Unity as “all about engaging with the public and helping them understand the challenges we are facing and thanking them for their support.”

Photograph: Terry Harris

Family farm tax petition handed to No.10

A petition, signed by more than 270,000 members of the public, urging the government to ditch its devastating family farm tax is handed into 10 Downing Street by NFU President Tom Bradshaw and NFU Cymru President Aled Jones, on behalf of the four UK farming unions.

In a joint statement, the four Presidents of the UK farming unions – Tom Bradshaw, Aled Jones, Martin Kennedy and William Irvine – said: “We will continue fighting because this is not just about our farms, but our families, our future and your food.”

Photograph: NFU President Tom Bradshaw, and NFU Cymru President Aled Jones delivering the petition to No. 10.

Growing list of retailers back the NFU’s Stop the Family Farm Tax campaign

All of the UK’s major supermarkets have publicly stated their shared concerns over the government’s proposed changes to inheritance tax, with more major retailers expected to follow suit.

NFU President Tom Bradshaw says that retailers are backing the campaign to stop the family farm tax because “they know that if it is allowed to devastate family farms it will also devastate retailers’ ability to source the high-quality, sustainable food their customers want.”

Read what the supermarkets have said.

Photograph: Kwangmoozaa/iStock

Pressure mounts to consult on IHT as Efra chair writes to PM

Criticism of the government’s proposed changes to inheritance tax continues to gather momentum as Efra Committee chair Alistair Carmichael pens a letter to the Prime Minister, backing the NFU’s call to pause and consult on the changes.

The letter compiles evidence from several sources, including NFU President Tom Bradshaw who has reacted to the letter: “It’s great to see the Efra Committee taking action after the NFU gave evidence on the devastating impacts of the family farm tax last month.”

Photograph: ParliamentTV

The OBR confirms fears around the impact of changes to IHT

The Office for Budget Responsibility says that government changes to inheritance tax on farms will likely leave elderly farmers horribly exposed. It also says that it is ‘highly uncertain’ whether the measures will raise the £500m the Treasury claims it will raise.

NFU President Tom Bradshaw reacts: “At every stage the government has consistently ignored what we have been telling them about this abhorrent policy. Is it now going to ignore the OBR too?”

Photograph: Alamy/Jeff Gilbert

Allied industries join call to stop the family farm tax

The NFU launches a pledge at LAMMA for allied industries to add their name and ask the government to pause and consult on proposed changes to APR and BPR.

Numerous agriculture-related industries at LAMMA expressed their concerns that their businesses will suffer because of the government’s proposed changes to APR and BPR.

Allied industries – Sign our pledge

Photograph: Simon Hadley Photography

UK food and farming leaders call for full consultation on IHT changes

UK farming organisations join forces to pen a letter to the Chancellor, outlining the need to conduct a full and comprehensive consultation on the proposed changes to inheritance tax.

NFU President Tom Bradshaw emphasises that “as a significant group of food and farming organisations from across the UK, we are urging the Chancellor to listen to our concerns".

“The government must extend its consultation on these reforms to safeguard the future of British farming,” he added.

Photograph: Alex MacNaughton / Alamy

Launch of NFU shop to support the Stop the Family Farm Tax campaign

Following the launch of the Stop The Family Farm Tax banner campaign, we have launched an NFU shop so that farmers and members of the public everywhere can access our campaign materials.

The NFU shop provides professionally produced, branded materials to support the Stop the Family Farm Tax campaign. We are committed to ensuring that no member of a UK farming union pays more than cost price for campaign materials. Any profit from public purchases will be directly reinvested into the Stop The Family Farm Tax campaign.

NFU criticises PM's comments on rationale for IHT changes

NFU President Tom Bradshaw branded the proposed changes to APR and BPR “an indiscriminate revenue-raising measure”.

This followed the Prime Minister’s appearance in front of the Liaison Committee where he stated that the purpose of the changes was to “raise revenue in the Budget”.

Read more about the committee session.

Photograph: Parliament tv

NFU signs letter calling for full consultation on IHT changes

The NFU is one of 32 trade associations that have joined forces through an open letter to the Chancellor, calling for a full and formal consultation on the proposed changes to inheritance tax.

NFU President Tom Bradshaw said: “No one thinks this is a good policy, not even the government’s own advisers. It’s time for Treasury to listen to farmers and the multiple other organisations calling for these proposals to be opened up for consultation.”

Photograph: Alex MacNaughton / Alamy

NFU President sends #StopTheFamilyFarmTax Christmas cards to MPs

NFU President Tom Bradshaw sends Christmas cards to all English and Welsh MPs calling on them to #StopTheFamilyFarmTax.

The image on the Christmas card depicts a row of empty wellies belonging to a farming family.

Photograph: Getty

NFU President writes to the Prime Minister and meets with the Defra Secretary of State

NFU President Tom Bradshaw writes to Prime Minister Sir Keir Starmer on farmers' concerns regarding the impacts of proposed changes to APR and BPR.

Tom also meets with the Defra Secretary of State Steve Reed to discuss the effects of wider government policy on British farmers and growers.

NFU tells government crucial covenant feels broken

NFU President Tom Bradshaw gives evidence to the Environment, Food and Rural Affairs Select Committee on the impacts of proposed changes to APR and BPR on the farming sector and wider rural communities.

Summarising the historic and current relationship between farming and the government, Tom says: “Ever since World War II, there has been a covenant between farming and government – that farming gets on and does its job of producing food, and it’s never really been about the returns, it’s been about that way of life, that heritage, that custodianship.

“Unfortunately with all the other changes in the Budget, along with this one, it feels like this covenant has been broken.”

Read NFU external affairs adviser Neeve McGinty's report.

Photograph: Parliament tv

NFU announces next steps for campaign to stop the family farm tax

NFU Council meets to agree a plan to take us through the Christmas period and January, as we start to approach the Finance Bill, the piece of legislation that would make the Chancellor’s tax raid on farms law.

- A new email your MP tool for members launches to keep the pressure on MPs. We want to combine this with targeted meetings where MPs meet farmers together with their accountants to really understand why the Treasury’s insistence that few people will be affected is wrong.

- We're also asking members to get involved in a huge banner campaign, using roadside banners, gate banners and car stickers, right across the whole UK.

- We're building towards a milestone event at Lamma in January, which there’ll be more information on soon.

Family farm tax debated in parliament

The Conservative Party uses its Opposition Day to table a motion against the government's proposed changes to APR.

Read NFU external affairs manager Emma Crosby's report.

Photograph: BBC

NFU holds banking roundtable

At its bi-annual banking roundtable, the NFU holds crucial discussions with several major banks to assess the potential impact of the government's recent Budget on farm business confidence and investment.

Public backs NFU campaign to overturn family farm tax

On 1 November, the NFU launches the campaign urging the government to think again following its Autumn Budget announcement.

NFU members, British farmers and the public joined forces to call on the government to reverse its decision on the APR (Agricultural Property Relief), with more than 120,000 people adding their names to the campaign action to stop the family farm tax.

An impact analysis of APR reforms on commercial family farms

We consult with former Treasury and Office for Budget Responsibility economists and publish an analysis of the impacts of the APR reforms on commercial family farms. This analysis demonstrates why we believe that the Treasury is working off the wrong figures.

NFU President meets with Prime Minister

NFU President Tom Bradshaw meets Prime Minister Sir Keir Starmer in a one-on-one meeting to hear directly from Tom about farmers’ concerns.

They discuss the impact of changes to inheritance taxes on farms, alongside a number of other topics including food security, trade and farming and growing in the UK more widely.

Family farm tax most unpopular measure in Autumn Budget, new polling finds

New polling, carried out by Portland this week, shows that changes to inheritance taxation on family farms are unpopular, and that perceptions that Labour does not value rural voters as highly as urban ones are building.

Inheritance tax on farms is revealed to be the joint most unpopular measure in the Budget, tied with changes to pensions.

The news comes as the NFU's campaign action to stop the family farm tax gains more than 255,000 signatures.

NFU organises a mass lobby to stop the family farm tax

Farmers and growers descend on London to meet with their MPs as part of the NFU’s call to action to reverse the family farm tax. NFU President Tom Bradshaw opens the mass lobby with an impassioned speech in Church House, Westminster with the presidents of the other UK farming unions on stage. Members then went to tell their story to their MPs.

Support for the call to action quickly rises with over 231,000 members of the public joining the call to overturn the family farm tax.

NFU meets with Defra and Treasury to discuss Inheritance Tax

NFU President Tom Bradshaw meets Defra Secretary of State Steve Reed and Treasury Minister James Murray to outline the impact of Inheritance Tax changes on family farms and national food security.

NFU leads calls for family farm tax to be reversed

Britain’s farmers and growers will take part in a mass lobby of their MPs on 19 November to highlight the devastating impact of the recent budget on their farms, with changes to Agricultural Property Relief dealing a hammer blow to farming families.

Show your support and call for the government to overturn the family farm tax.

Photograph: Mike Booth / Alamy

Budget blow for British farming, says NFU

The NFU responds to Chancellor Rachel Reeves' Autumn Budget announcement, warning that new measures could lead to food price rises.

New measures include changes to APR (Agricultural Property Relief) that are likely to impact significant numbers of farm estates, including small and medium-sized enterprises, and an above-inflation hike in the NLW (National Living Wage), with the rate for over 21s increasing 6.7% to £12.21 from April.

Farming industry writes to Chancellor amid fears of inheritance tax relief changes

The UK farming industry comes together to warn the Chancellor about the crippling effect changes to inheritance tax reliefs, including APR and BPR, would have on family farms, tenant farmers, domestic food security and environmental delivery.

Photograph: Alex MacNaughton / Alamy

APR changes would put family farms at risk, warns NFU

Reports that the Treasury is considering major changes to agricultural property relief as part of the forthcoming budget spark concern among farmers and growers.

NFU analysis of APR suggests that scrapping it would only save the Treasury £120 million per year, while the negative impact on farming would be much larger.

The NFU secures a debate in parliament this on the issue.

7 key Autumn Budget asks – NFU writes to the Chancellor

The NFU writes to the Chancellor outlining the key asks for farming – chief among them is the need for a multi-year agriculture budget of £5.6 billion.

We are also seeking confirmation that there will be no changes to APR (Agricultural Property Relief) which currently exempts farmland from inheritance tax.

The NFU believes that any removal of APR is unlikely to raise much in the way of tax, but could lead to a contraction in the amount of rental land for farmers.

Photograph: amanda rose / Alamy

Parliament debates the agriculture budget

Following NFU lobbying, MPs from across the House of Commons call on the government to deliver an increased agriculture budget after an opposition debate day raises the importance of farming to Britain’s food security, environment and economic growth.

NFU launches 'write to your MP' campaign action

NFU President Tom Bradshaw brands newly released Defra figures as “unacceptable”, after they showed a £130 million yearly underspend against plans between April 2023 and March 2024.

The NFU had repeatedly shared its concerns about this issue.

On Back British Farming Day, the NFU calls for the government to deliver a renewed and enhanced multi-annual agriculture budget of £5.6 billion in the Autumn Budget on 30 October.

The NFU hosts a fringe event at the Labour Party Conference with Food Security and Rural Affairs Minister Daniel Zeichner on the panel. We reiterate our call for an increased budget.

Defra Secretary commits to making farming's case to Treasury

At the NFU's Back British Farming Day parliamentary reception, Defra Secretary of State Steve Reed pledges to make farming’s case to the Treasury.

‘Food security is our shared mission’, Farming Minister tells NFU MP reception

NFU holds first parliamentary reception after the State Opening of the new parliament. NFU President Tom Bradshaw pushes Minister Daniel Zeichner on the budget.

NFU has first meeting with new Defra Secretary

NFU President Tom Bradshaw meets new Defra Secretary Steve Reed.

After the meeting Tom says: “Steve Reed has just outlined his plan for change and it’s good to hear that food security, the environment and flood management are all focus areas. These now need to be underpinned by a budget that will enable the necessary investment.”

NFU meets with parliamentary candidates

In the run up to the election the NFU meets with almost 400 candidates, ensuring our message on the budget is heard.

General election announced

The government announces a general election to take place on 4 July. The NFU continues to make the case for an agriculture budget that delivers for British farming and growing.

No. 10 hosts second Farm to Fork Summit

The NFU has secured major wins and explored ways to restore farmers’ confidence at the second Farm to Fork summit.

The summit coincides with several announcements which represent major wins for the NFU.

NFU launches its general election manifesto

The NFU launches its Farming for Britain’s Future key policy asks ahead of an anticipated general election. These asks contain research from The Andersons Centre that explains why a robust agriculture budget must deliver for the stability and productivity of farming alongside the environment.