We communicate a range of indicators of economic activity in the UK labour market that can be used as a guide for employers when conducting periodic pay reviews for workers.

The indicators include average weekly earnings, wages including the National Minimum Wage and the National Living Wage, cost of living (Consumer Price Index and Retail Price Index) and farm business profitability.

You can also download a PDF copy of the latest key labour market indicators.

Headline figures – September 2025

Key Labour Market Indicators are designed to provide headline figures on the wider economic and labour market conditions in the UK. This can be used as a quick reference guide when conducting periodic pay reviews for workers.

Earnings in the economy

+4.8% AWE (Average Weekly Earnings)

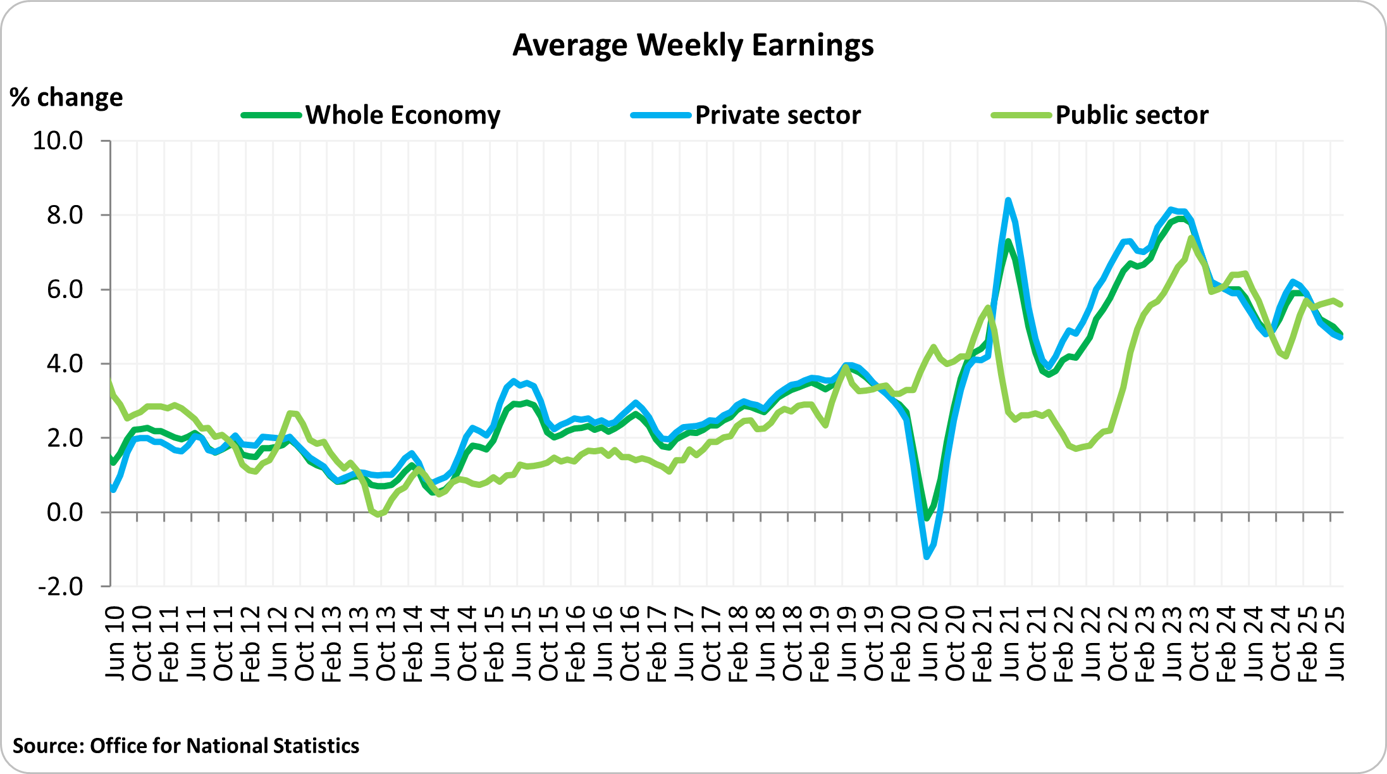

This is the key National Statistics indicator of short-term earnings growth and with monthly estimates of the level of AWE per worker/employee. It provides details of AWE for the UK economy as whole as well as the level of pay within other sectors. The year-on-year change in average pay is a useful indicator of wage changes in the wider economy.

Figures from the ONS (Office for National Statistics) show wage growth was 4.8% in the three months to July.

Earnings are still outpacing inflation, private sector pay grew at an annual pace of 4.7%, while in the public sector it was 5.6%.

The wholesaling, retailing, hotels and restaurants sector still showed the strongest regular annual growth rate.

Wage rates

£12.21 Current NLW rate

The government has announced increases to wage rates. The new rates came into effect on 1 April 2025.

The NLW (National Living Wage) paid to workers aged 21 and over rose 6.7%, from £11.44/hour to £12.21/hour.

For 18 to 20-year-olds, the minimum wage increased from £8.60 to £10.

The accommodation offset rate increased to £10.66 per day, a 67p increase from the previous rate, an increase of 6.7%.

Apprentices and those aged under 18 got a pay increase from £6.40/hour to £7.55/hour.

For more information, visit: National Living Wage and Minimum Wage increases – what you need to know.

| Rates from April 2025 | |

| NLW 23+ | £12.21 |

| 21-22-year-old rate | £12.21 |

| 18-20-year-old rate | £10.00 |

| 16-17-year-old rate | £7.55 |

| Apprentice rate | £7.55 |

| Accommodation offset | £10.66 per day |

Source: Low pay commission

Cost of living

+3.8% CPI (Consumer Price Index)

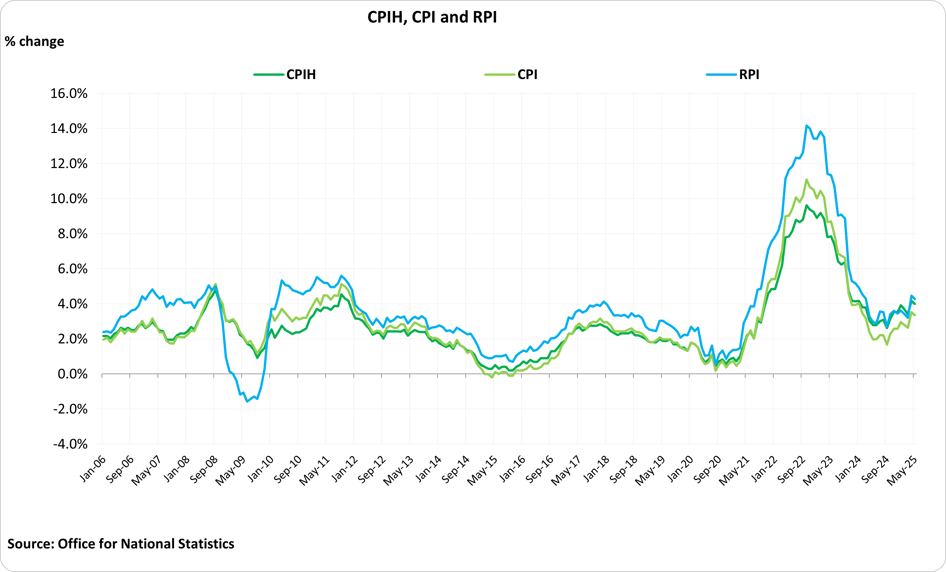

CPI measures changes in the price level of the labour market based on consumer goods and services purchased by households. RPI measures inflation, but also includes the costs of housing (eg, mortgage interest costs and council tax), while CPI does not.

The UK inflation rate, as measured by the CPI, remained at 3.8% in the year to August, well above the Bank of England's 2% target according to figures from the ONS.

Food prices increased by 5.1% (4.8% excluding non-alcoholic beverages) in the year to August – the highest rate for 18 months – and has now risen for five months in a row.

Data also shows that inflation in the UK was “significantly higher” than large European economies such as France and Germany.

Farm business profitability

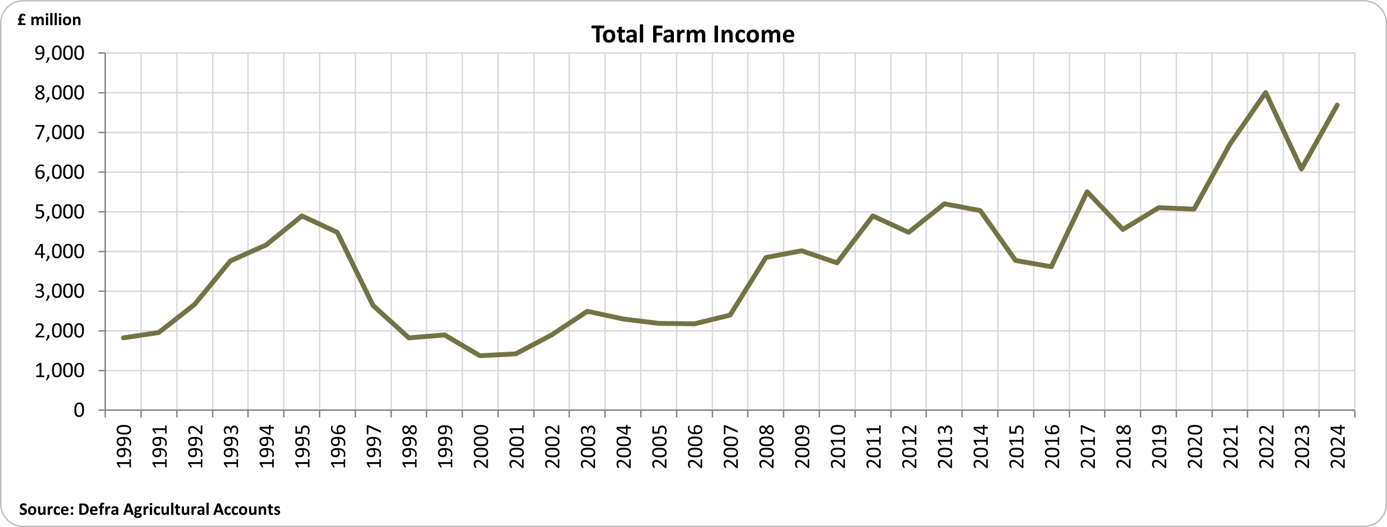

-9.8% TIFF (Total Income from Farming)

Defra has published results of TIFF for 2024. The TIFF is a measure of the performance of the whole agricultural industry in the UK. The profitability of UK farming for 2024 was £7.7 billion, an increase of £1.6 billion (+26.4%) from 2023.

Following price volatility in 2022 and 2023, this large increase in TIFF was driven by a decrease of £1.2 billion in the value of inputs coupled with a £0.4 billion increase in the value of outputs.

Sign in if you’re already a member