Responsible for oversight of markets, banking payments and innovation, and resolution directorates, Sir David opened his keynote speech by acknowledging the contribution agriculture makes to the economy and further afield.

In his financial address, Sir David outlined the main issues affecting the farming industry and whether the economy can prove to be resilient to the risks posed by Brexit, Covid and energy prices.

He said: “Agriculture contributes almost £10 billion of the UK’s GDP, and the wider agri-food sector contributes £127 billion or 6.5% of the national food production.”

“But numbers don’t do justice to the significance of what farming brings, not just for the economy but for wider society and the environment.”

As a member of the Monetary Policy Committee (MPC), the Financial Policy Committee and the Prudential Regulation Committee, Sir David emphasised how his network “recognises the key challenges for NFU members today”.

He continued: “The MPC sets monetary policy for the economy as a whole, but to be able to do that we need to understand in detail what is happening across all sectors of the economy and in all regions and nations. This includes farming, an important sector in its own right, and an important link in the wider agri-food supply chain.”

He identified the main issues affecting the farming economy in 2022 as being:

- The immediate cost increases of raw materials in the past year, as well as a tight labour market and rising wages.

- Disruption. This could be from adverse weather, but also from adjustment to shocks hitting the economy due to Covid, post-Brexit trading arrangements and new ELM scheme.

- The future of the sector. The farming sector is keen to work towards net zero and improve its productivity through technology.

He described three ‘shocks’ as reasons for the current position the UK economy finds itself in: Brexit; Covid and energy prices.

Sir David then explained the big question is: Can the economy prove resilient to the risks posed by these three shocks?

"The scarring effects of Covid appear to be smaller than we might have feared, partly because of substantial economic measures that were put in place, in particular the government’s furlough scheme."

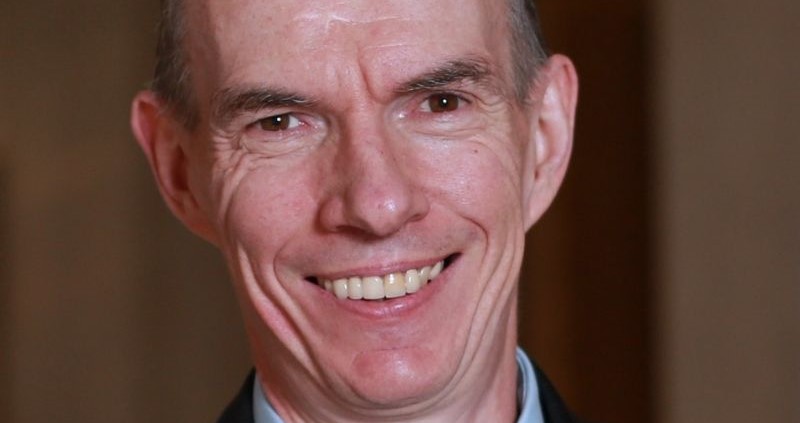

Sir David Ramsden CBE, Deputy Governor for Markets & Banking at the Bank of England

What is economic resilience?

Sir David defines it as: “The ability of the economy to withstand and recover from shocks, in other words, unexpected economic difficulty.”

The role of the Bank of England in supporting the UK’s economic resilience is laid out in its mission ‘to promote the good of the people of the UK by maintaining monetary and financial stability’.

The bank’s MPC works to maintain monetary stability by keep inflation low and stable, close to its target rate of 2% per year while minimising undesirable volatility.

What next?

Regarding the issues with global supply chain, Sir David said that the MPC believes global supply chain bottlenecks should fade over the next 12 months.

And given that the Covid shock came soon after the UK left the EU on 31 Jan 2020 and during the transition period, it’s impossible to separate out the effects of Covid from the ongoing effects of leaving the EU. The effects of Brexit are expected to build over time and lead to some persistent and negative impacts on GDP – economists call this ‘scarring’.

He explained: “However, these scarring effects of Covid appear to be smaller than we might have feared, partly because of substantial economic measures that were put in place, in particular the government’s furlough scheme.”

The MPC estimates Covid scarring will have an effect of around 1% on GDP, about a third of the predicted effects of Brexit. Sir David said: “A question remains about whether the combined Brexit and Covid shocks have had a more fundamental impact on the flexibility or responsiveness on the UK labour market.”

Above: NFU President Minette Batters puts questions to Sir David Ramsden CBE

Energy crisis

Sir David went on to speak about the dramatic rises in energy prices. In some cases, oil prices have more than doubled what they were in the last quarter of 2020 and gas prices have quadrupled. He explained this is due to a mix of demand in a recovering economy, disruptions to supply chain and geo-political tensions increasing. And this has been reflected in inflation.

Sir David explained he is expecting inflation to peak at 7.25%. and to see UK disposable income to decrease in the not-too-distant future.

‘A stable foundation’

He concluded: “These are challenging times for the UK economy and UK households and businesses, including in farming. But the UK economy, like the farming industry, has so far proved resilient, notwithstanding the scarring effects of Covid and Brexit, and has weathered the shocks and returned to pre-Covid levels of output.

“Can the UK economy build on the resilience shown to date, and continue to expand in the face of ongoing effects from energy prices and other shocks in this age of uncertainty? How the UK makes the best of the opportunities in a post-pandemic net zero future and what the blueprint for that future should look like will depend on policies well beyond the remit of the Bank of England’s MPC. But what the MPC can do is ensure a stable foundation for future developments. We are currently experiencing a period of inflation higher than we have seen for many years and that will have real consequences for UK households and businesses.

“But unlike earlier inflationary episodes, this time we have a framework that empowers us to take action and to set monetary policy so as to achieve the 2% CPI inflation target sustainably in the medium term.”